Show table of content Hide table of content

Global shipping stands at a crossroads where environmental imperatives collide with operational demands. While maritime transport accounts for roughly 3% of worldwide CO₂ emissions through burning 350 million tonnes of fossil fuels annually, the industry faces mounting pressure to reinvent itself completely. Conventional approaches like slow steaming reduce emissions but create logistical bottlenecks and prevent vessels from reaching design speeds. With the International Maritime Organization setting carbon neutrality targets around 2050, radical solutions have become unavoidable rather than optional.

Britain’s strategic bid for nuclear shipping leadership

A new British nuclear maritime consortium has emerged to transform commercial shipping through advanced nuclear propulsion systems. Lloyd’s Register spearheaded this initiative, assembling a coalition that extends far beyond engineering challenges. The consortium recognizes that technological capability alone cannot unlock the €3,000 billion potential market for nuclear-powered vessels and floating nuclear installations. Success depends equally on regulatory frameworks, insurance structures, and financial mechanisms that currently remain undefined.

The United Kingdom leverages unique advantages for this venture. Centuries of maritime dominance through the Royal Navy and trading companies established deep institutional knowledge, while decades of naval nuclear reactor experience created specialized engineering capabilities. London’s position as a global financial hub adds another strategic layer, connecting technical innovation with capital markets and insurance mechanisms. This convergence of maritime heritage, nuclear expertise, and financial infrastructure positions Britain distinctively within the emerging nuclear shipping landscape, much like how technological advances reshape various sectors from innovative thermal imaging systems to transportation networks.

The consortium brings together complementary capabilities across the entire value chain. Rolls-Royce contributes nuclear lifecycle management expertise, Babcock International Group handles naval engineering and operational support, while Global Nuclear Security Partners, Stephenson Harwood, and NorthStandard address security protocols, maritime law, and insurance requirements. This deliberate structure acknowledges that nuclear merchant vessels must be simultaneously certifiable, insurable, and financeable before any commercial deployment can proceed.

Technical architecture and regulatory framework development

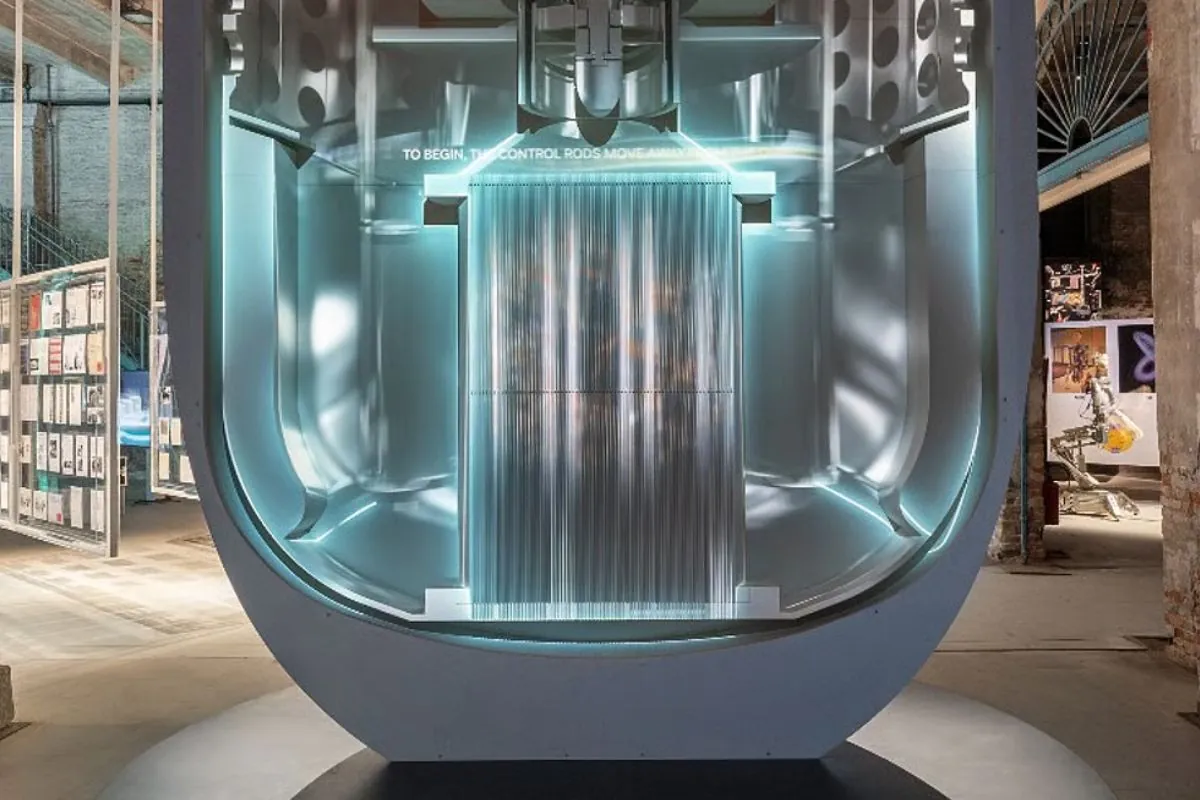

The consortium focuses on Advanced Modular Reactors (AMRs) designed specifically for maritime environments. These compact, standardized units promise multi-year operation without refueling, zero direct carbon emissions, and integrated safety systems from initial design phases. Unlike traditional power plants adapted for ships, AMRs represent purpose-built solutions addressing unique challenges of oceanic operation including motion, corrosion, space constraints, and emergency protocols.

ScienceAt 408 mph, this drone has just set a Guinness-certified record and the best part is, it was entirely built in-house using a 3D printerFive priority workstreams structure the initial roadmap. First, demonstrating that generic modular reactor designs can achieve licensing approval across different port facilities. Second, creating certification frameworks that satisfy both nuclear regulatory bodies and maritime classification societies simultaneously. Third, establishing security and safeguard architectures meeting international standards while remaining operationally practical. Fourth, defining insurance pathways that quantify and distribute risks acceptably for underwriters. Fifth, publishing operational guidelines enabling governments and industry players to navigate this emerging field, similar to how infrastructure challenges affect autonomous vehicle deployment.

| Workstream | Primary objective | Key stakeholders |

|---|---|---|

| Reactor licensing | Multi-site design approval | Nuclear regulators, port authorities |

| Certification framework | Unified nuclear-maritime standards | Classification societies, IMO |

| Security architecture | International compliance protocols | IAEA, national security agencies |

| Insurance pathways | Risk quantification models | Underwriters, P&I clubs |

| Operational guidelines | Industry implementation roadmap | Shipowners, governments |

Research conducted jointly by Core Power, NorthStandard, and Lloyd’s Register quantifies the commercial opportunity at approximately £2,500 billion sterling, equivalent to nearly €3,000 billion across nuclear-powered shipping and floating nuclear power facilities. This valuation reflects long-term market development rather than immediate revenue, acknowledging that infrastructure development, regulatory establishment, and public acceptance will unfold over decades rather than years.

International competition and alternative approaches

Britain faces significant international competition despite its historical advantages. The Franco-Italian collaboration between newcleo and Fincantieri exemplifies alternative pathways toward maritime nuclear propulsion. Their TL-40 reactor employs fourth-generation lead-cooled fast reactor technology, designed as a compact AMR suitable for modern cargo vessels. This partnership divides responsibilities strategically : newcleo provides nuclear engineering and energy systems expertise, while Fincantieri ensures practical shipboard integration meeting safety, efficiency, and operational requirements. Such developments parallel how nations pursue technological independence in other domains, including digital infrastructure.

Additional projects span multiple continents and technological approaches. Norway’s Norsk Kjernekraft and Ocean-Power develop units generating 200 to 250 megawatts, while Indonesian initiatives with Seaborg and Copenhagen Atomics explore 100 to 500 megawatt solutions adapted for archipelagic geography. These diverse projects reflect varying national priorities : Arctic operations, island electrification, industrial power supply, and desalination applications each demand customized reactor configurations and deployment strategies.

Floating nuclear power facilities and operational precedents

Beyond propulsion applications, floating nuclear power stations represent parallel opportunities within the broader market estimation. These installations consist of barges or vessels equipped with compact reactors providing electricity to coastal regions, ports, or industrial facilities bypassing terrestrial grid limitations. Russia’s Akademik Lomonosov, operational since 2019 in Arctic regions delivering approximately 70 megawatts electrical output, remains the sole functioning example currently.

Several concepts advance this model further. Core Power and Westinghouse develop barge designs incorporating microreactors or molten salt reactors supporting ports, industries, desalination plants, and hydrogen production facilities. These applications target specific scenarios where conventional power infrastructure proves impractical or uneconomical : remote mining operations, island communities, disaster recovery situations, and temporary industrial projects. The technology enables power delivery independent of existing grids, though it inherits nuclear energy’s persistent challenges regarding waste management and public acceptance, issues that affect technological advancement across multiple fields including space infrastructure.

ScienceChina achieves an engineering feat with a world record for this hydrogen “super-turbine” capable of powering 5,500 homesMilitary fleets currently operate over 700 nuclear reactors at sea, demonstrating technical feasibility established across decades. The 2026 challenge therefore centers not on fundamental technology but rather on industrial scaling, regulatory harmonization, and insurance mechanisms enabling commercial deployment. Success requires coordinating multiple domains simultaneously : engineering advances that enhance navigation capabilities, legal frameworks spanning international maritime law and nuclear non-proliferation treaties, and financial structures distributing risks acceptably among shipowners, operators, and insurers.

Both nuclear propulsion and floating power installations confront identical criticisms regarding safety protocols and radioactive waste management. Public perception, regulatory approval timelines, and insurance costs will ultimately determine whether these technologies achieve widespread commercial adoption or remain confined to specialized applications. The British consortium’s comprehensive approach addressing technical, legal, and financial dimensions simultaneously represents recognition that engineering excellence alone cannot unlock this market without parallel progress across regulatory and commercial infrastructure.